United States Toys Market Size and Share Analysis – Top Companies Analysis and GrowthTrends Insight Forecast Report 2025-2033

United States Toys Market Size and Share Analysis Report (2025–2033) Market Overview The United States toys market is projected to...

United States Toys Market Size and Share Analysis Report (2025–2033)

Market Overview

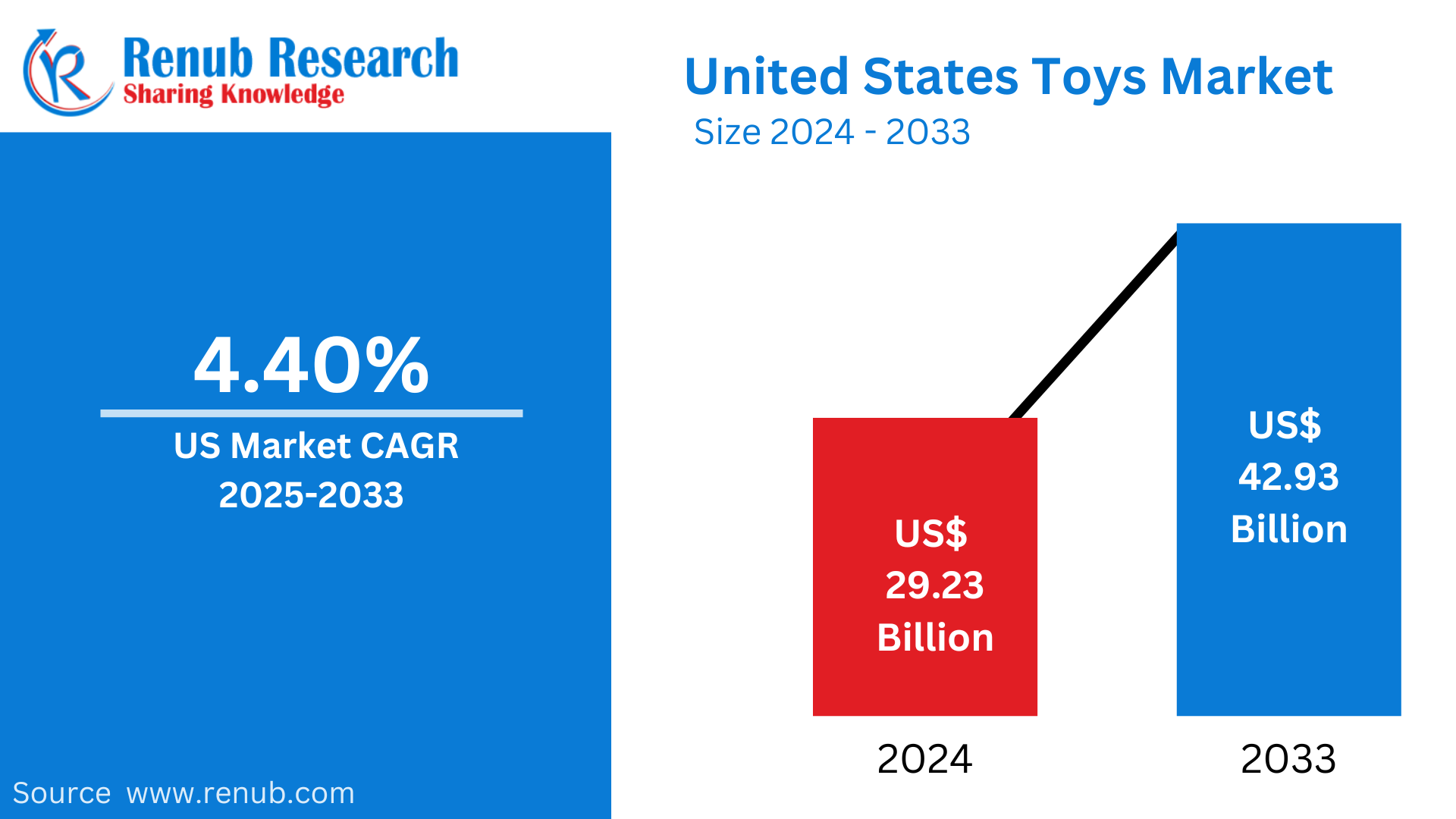

The United States toys market is projected to reach approximately US$ 42.93 Billion by 2033, increasing from US$ 29.23 Billion in 2024, with a CAGR of 4.40% during the forecast period. The growing demand for interactive, educational, and tech-enabled toys, alongside consumer preferences shaped by trends in entertainment and learning, continues to drive market expansion.

Introduction to the U.S. Toys Market

Toys are essential play tools that promote entertainment, education, creativity, and social development among children. Though primarily aimed at kids, toys also cater to collectors and adults. The U.S. toy market—one of the world’s largest—reflects a mix of traditional toys and tech-savvy innovations such as robotic kits, AR toys, and STEM-based educational kits. Major cultural events like Christmas, birthdays, and other festive seasons significantly boost toy sales.

By 2024, there will be approximately 74.6 million children in the U.S., and the country’s total population is expected to grow from 342 million in 2024 to 383 million by 2054, as per the Congressional Budget Office (CBO)—further supporting long-term market demand.

Key Market Drivers

1. Rising Demand for STEM and Educational Toys

With the increasing emphasis on STEM education, toys designed to enhance skills in science, technology, engineering, and mathematics have gained traction. Parents increasingly prefer toys that foster cognitive growth and prepare children for future careers. Noteworthy is Toycra’s 2023 launch of “OpenEnded” toys tailored for experiential learning.

2. Growth in Digital-Interactive and Smart Toys

Digital transformation in toys—such as AI-powered robots, AR games, and interactive plushies—is reshaping playtime. Ms. Rachel’s 2024 release of educational sensory toys exemplifies how learning and fun are now seamlessly integrated through technology.

3. Popularity of Franchise-Based Collectibles

Toys based on blockbuster franchises like Marvel, Star Wars, and Disney dominate shelves. These collectibles are popular among kids and adult collectors, contributing to recurring purchases and brand loyalty. For instance, Hasbro expanded its Playskool lineup in 2024 through a partnership with PlayMonster.

Major Challenges in the U.S. Toy Market

1. Supply Chain Disruptions

Most toys sold in the U.S. are imported. Hence, delays in shipping, raw material shortages, and labor issues disrupt inventory—especially during peak seasons. Manufacturers are now exploring localized production to counter these risks.

2. Complex Regulatory Frameworks

Toy manufacturers must comply with strict safety regulations, covering non-toxic materials, choking hazards, and age-appropriate designs. Navigating evolving rules poses challenges for especially small and medium toy businesses.

Detailed Segment Analysis

Action Figures & Accessories

Driven by franchises like Marvel, Transformers, and Star Wars, the action figures market enjoys enduring appeal. Accessories like vehicles and playsets enhance storytelling and replay value.

Dolls

A staple in American toy culture, dolls now reflect greater inclusivity—showcasing diversity in ethnicity, body types, and disabilities. This shift aligns with social progress and boosts market relevance.

Games and Puzzles

With screen fatigue setting in, families are returning to interactive tabletop games. Strategy games and puzzles are seeing strong online sales and are valued for their social and developmental benefits.

Distribution Channel Insights

E-commerce

Online platforms dominate the toy retail space due to convenience, price comparisons, and consumer reviews. In September 2024, Macy’s and Toys”R”Us teamed up to launch the Geoffrey’s Hot Toy List 2024, promoting 150 top toys for the holiday season.

Specialty Toy Stores

Boutique and specialty toy shops focus on quality, creativity, and educational value. An example is the launch of Melissa & Doug’s physical store in New York in 2023, catering to niche but high-value toy shoppers.

Related Report

- Licensed Sports Merchandise Market Report Global Forecast By Product (Sports Apparel, Sports Footwear, Toy & Games, Others), Distribution Channel (Online, Offline), Countries and Company Analysis (2025-2033)

- Germany Toy Market Report Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- France Toys Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

U.S. Toys Market Segmentation

By Toy Type (11 Segments)

- Action Figures & Accessories

- Arts & Crafts

- Building Sets

- Dolls

- Explorative & Other Toys

- Games/Puzzles

- Infant/Toddler/Preschool Toys

- Outdoor & Sports Toys

- Plush

- Vehicles

- Youth Electronics

By Sales Channel (5 Segments)

- E-commerce

- Specialty

- Discounters

- Department Stores

- Others

Leading Companies Covered

Each company is analyzed by Overview, Recent Developments, and Revenue:

- Mattel Inc.

- Hasbro Inc.

- LEGO

- Spin Master Corp.

- Vtech

- Nintendo Company Ltd.

- Funko Inc.

- JAKKS Pacific

Report Details

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2020–2024 |

| Forecast Period | 2025–2033 |

| Market Value | US$ Billion |

| Coverage | Toys Segment and Sales Channel |

| Companies Covered | 8 Key Players |

10 Key Questions Answered in the Report

- What is the current size of the U.S. toys market and its forecast until 2033?

- What are the major factors driving growth in educational and STEM toys?

- How are digital and interactive technologies transforming toy design and usage?

- What role do movie and TV franchises play in the collectible toy segment?

- How is the rise of e-commerce reshaping the toy sales landscape in the U.S.?

- What are the key challenges related to toy safety regulations and compliance?

- How are supply chain issues affecting toy availability and pricing?

- What are the top-selling toy segments and how are they evolving?

- How are U.S. specialty toy stores competing with mass-market retailers?

- Which companies are leading the U.S. toy market and what are their recent innovations?