Saudi Arabia Coffee Market Trends 2025-2033

Saudi Arabia Coffee Market Forecast Report (2025-2033) Market Overview The Saudi Arabian coffee market is poised for significant expansion, with...

Saudi Arabia Coffee Market Forecast Report (2025-2033)

Market Overview

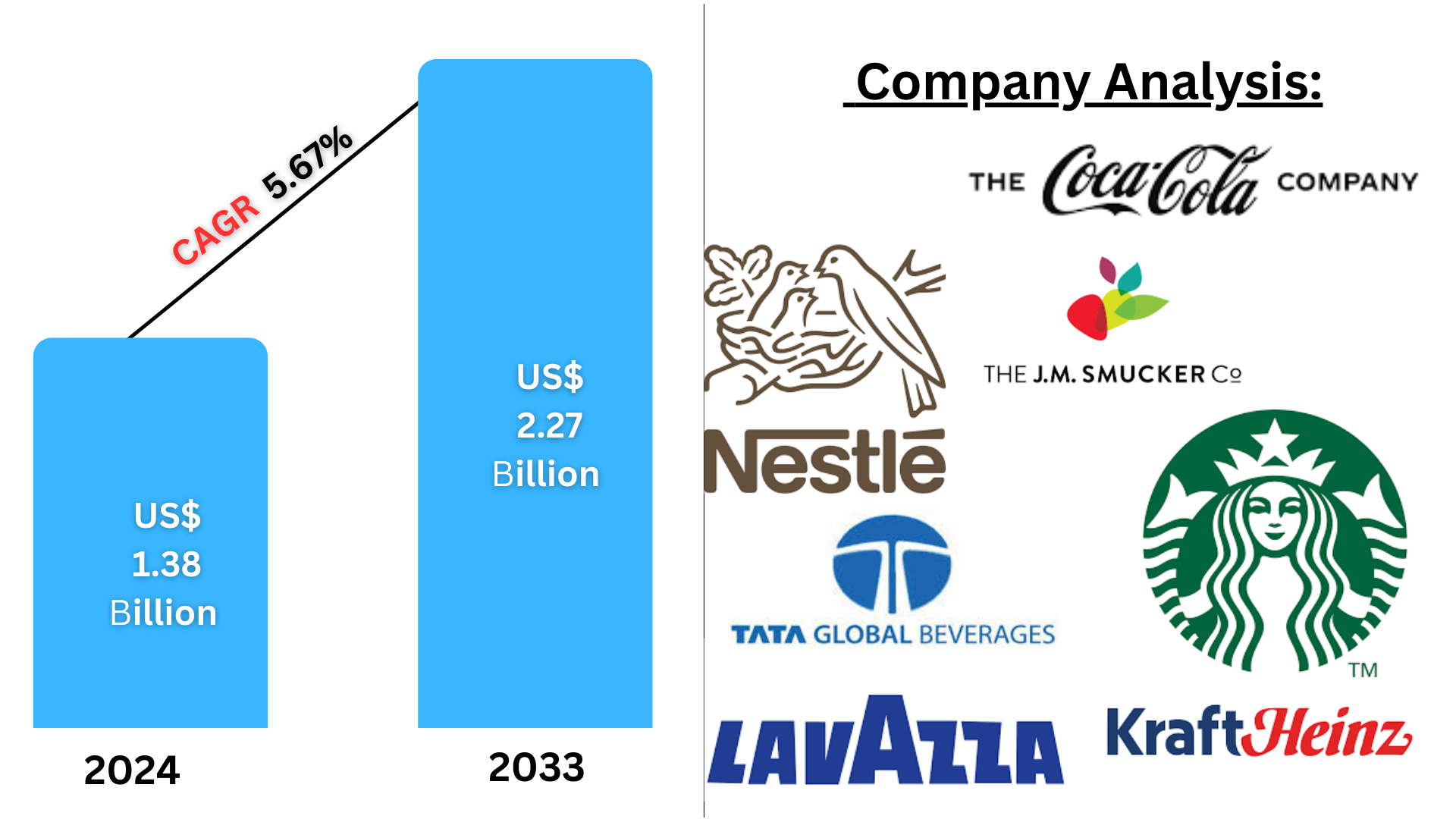

The Saudi Arabian coffee market is poised for significant expansion, with its valuation projected to rise from USD 1.38 billion in 2024 to USD 2.27 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 5.67%. This growth trajectory is driven by several key factors, including the deep-rooted cultural significance of coffee, a booming café culture fueled by younger demographics, and government-led initiatives under Vision 2030, such as the Saudi Coffee Initiative, which aims to develop local coffee production and elevate its global reputation.

Download Sample: https://www.renub.com/request-sample-page.php?gturl=saudi-arabia-coffee-market-p.php

Market Outlook & Cultural Significance

Coffee has historically played a vital role in Saudi Arabian culture. Locally known as “Gahwa,” Saudi coffee is a symbol of hospitality and tradition, typically prepared with lightly roasted beans infused with cardamom and other spices. It is an essential component of social gatherings, business meetings, and religious festivities. Despite the emergence of modern coffee consumption habits, the demand for traditional Saudi coffee remains steadfast.

The market’s expansion is propelled by the dynamic interplay between heritage and contemporary coffee consumption trends. Urbanization and globalization have introduced new coffee preferences, with Saudi consumers now embracing specialty brews, espresso-based drinks, and cold brews. These evolving consumer habits are complemented by an increasing number of premium coffee chains and independent specialty cafés that cater to both traditional and modern tastes.

Key Growth Drivers

1. Cultural Significance & Traditional Practices

- Coffee holds deep-rooted cultural importance in Saudi Arabia, where it symbolizes hospitality and social connection.

- The government actively promotes traditional coffee practices through initiatives that integrate heritage with modern consumption trends.

- Events celebrating Saudi coffee traditions contribute to consistent demand and market growth.

- The Torch Coffee Company’s plan to plant 1.3 million coffee trees nationwide by 2025 aims to quadruple national production to 40,000 bags by 2028.

2. Flourishing Café Culture & Youth Influence

- The rise of specialty coffee shops and international coffee chains is reshaping Saudi Arabia’s urban coffee scene.

- Millennials and Gen Z are driving the surge in coffee consumption, favoring modern coffee experiences such as artisanal brews and Instagram-worthy beverages.

- Social media plays a crucial role in influencing coffee trends, encouraging more experimentation and higher spending on premium coffee.

- Saudi Arabia’s youthful demographic (63% of citizens are under 30) further strengthens the market’s expansion potential.

3. Government Support & Vision 2030 Initiatives

- The Saudi government, through Vision 2030, aims to diversify the economy by strengthening local coffee production and trade.

- The Saudi Coffee Initiative fosters the growth of specialty coffee in regions like Jazan, known for its optimal coffee-growing conditions.

- The Public Investment Fund (PIF) launched the Saudi Coffee Company in 2022, committing $319 million over ten years to enhance domestic coffee production and consumption.

- Saudi Arabia joined the International Coffee Agreement, bringing technical support and resources to local coffee farmers.

- Plans to establish a “coffee city” and integrate Saudi coffee into UNESCO’s list of intangible cultural heritage further highlight the government’s commitment.

Market Segmentation

By Type:

- Instant Coffee – Preferred for its convenience and affordability.

- Ground Coffee – Favored for home brewing and specialty café consumption.

- Whole Grain Coffee – Increasing in demand due to a growing interest in artisanal and organic coffee.

- Others – Includes coffee-based beverages and specialty coffee blends.

By Distribution Channel:

- Supermarkets & Hypermarkets – The dominant retail channels, offering a diverse range of coffee products.

- Convenience Stores – Popular among consumers seeking quick and accessible coffee purchases.

- Online Retail – Experiencing rapid growth due to digital shopping trends and the availability of international brands.

- Others – Includes specialty coffee shops, direct farm-to-consumer sales, and boutique roasters.

Competitive Landscape & Key Players

Saudi Arabia’s coffee market is characterized by a strong presence of both domestic and international players. Major industry participants include:

- The J. M. Smucker Company

- The Kraft Heinz Company

- Nestlé SA

- Starbucks Coffee Company

- Luigi Lavazza S.p.A.

- Tata Global Beverages

- The Coca-Cola Company

Local brands such as Barns Coffee, which operates over 500 stores, are also key players in shaping the market. The Saudi Coffee Company is working towards expanding the domestic coffee industry by investing in import businesses, roasting facilities, coffee shop franchises, and barista training academies.

Recent Developments in the Saudi Coffee Industry

- May 2024: The Royal Commission for Jubail and Yanbu granted a license to the Saudi Coffee Company to establish a coffee manufacturing facility in Jazan.

- March 2024: Alghanim Industries partnered with the Saudi Coffee Company to elevate the global recognition of Jazean, Saudi Arabia’s specialty coffee brand.

- July 2024: Gulf Trading Company introduced a new coffee product line, “Al Rifai,” further diversifying market offerings.

- September 2023: The Saudi Coffee Company launched its in-house brand, JAZEAN, focusing on sustainability and high-quality Arabica beans.

Future Outlook & Market Potential

Saudi Arabia’s coffee industry is at the forefront of transformation, with government-backed initiatives and private sector investments driving its expansion. The country’s ambitious plans include:

- Increasing local coffee production from 300 tonnes to 2,500 tonnes annually by 2033.

- Providing financial and technical support to coffee farmers, enhancing cultivation techniques and sustainability practices.

- Boosting the specialty coffee market through innovation, research, and development.

- Strengthening Saudi Arabia’s position as a regional coffee hub through strategic partnerships and global branding efforts.

- Expanding the local coffee industry to integrate Saudi-grown beans into international supply chains, enhancing their appeal on the global stage.

Conclusion

The Saudi Arabia coffee market is undergoing a remarkable evolution, fueled by a blend of cultural traditions, modern consumer preferences, and strategic government initiatives. The continued rise of specialty coffee, a flourishing café culture, and an increasing focus on local coffee production are setting the stage for sustained growth. With an estimated CAGR of 5.67%, the market presents significant opportunities for both local and international stakeholders looking to capitalize on Saudi Arabia’s burgeoning coffee industry.

Report Details

| Feature | Details |

| Base Year | 2024 |

| Historical Period | 2020 – 2024 |

| Forecast Period | 2025 – 2033 |

| Market Size | USD Billion |

| Covered Segments | Type, Distribution Channel |

| Companies Covered | Nestlé SA, Starbucks, Lavazza, Kraft Heinz, Coca-Cola, Tata Global Beverages, J. M. Smucker |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF & Excel (PPT/Word available on request) |

For further insights and customization, contact our analysts at [email protected] or call +1-678-302-0700 (USA) / +91-120-421-9822 (India).