Rabies Diagnostics Market: Industry Trends, Drivers, and Forecast (2025–2033)

Introduction Rabies remains one of the most deadly viral diseases known to humanity. Caused by the Rabies lyssavirus, the disease...

Introduction

Rabies remains one of the most deadly viral diseases known to humanity. Caused by the Rabies lyssavirus, the disease is nearly always fatal once symptoms appear. Despite being preventable, rabies continues to claim tens of thousands of lives annually, primarily in Asia and Africa. The increasing global emphasis on preventive healthcare, public health education, and early detection is spurring the growth of the rabies diagnostics market.

Accurate and timely diagnosis of rabies is crucial for both humans and animals, as it informs decisions regarding post-exposure prophylaxis (PEP), surveillance, and control programs. With the rising focus on eliminating rabies-related deaths by 2030, significant investments and innovations are transforming the rabies diagnostics landscape.

Market Overview

Current Market Size and Forecast

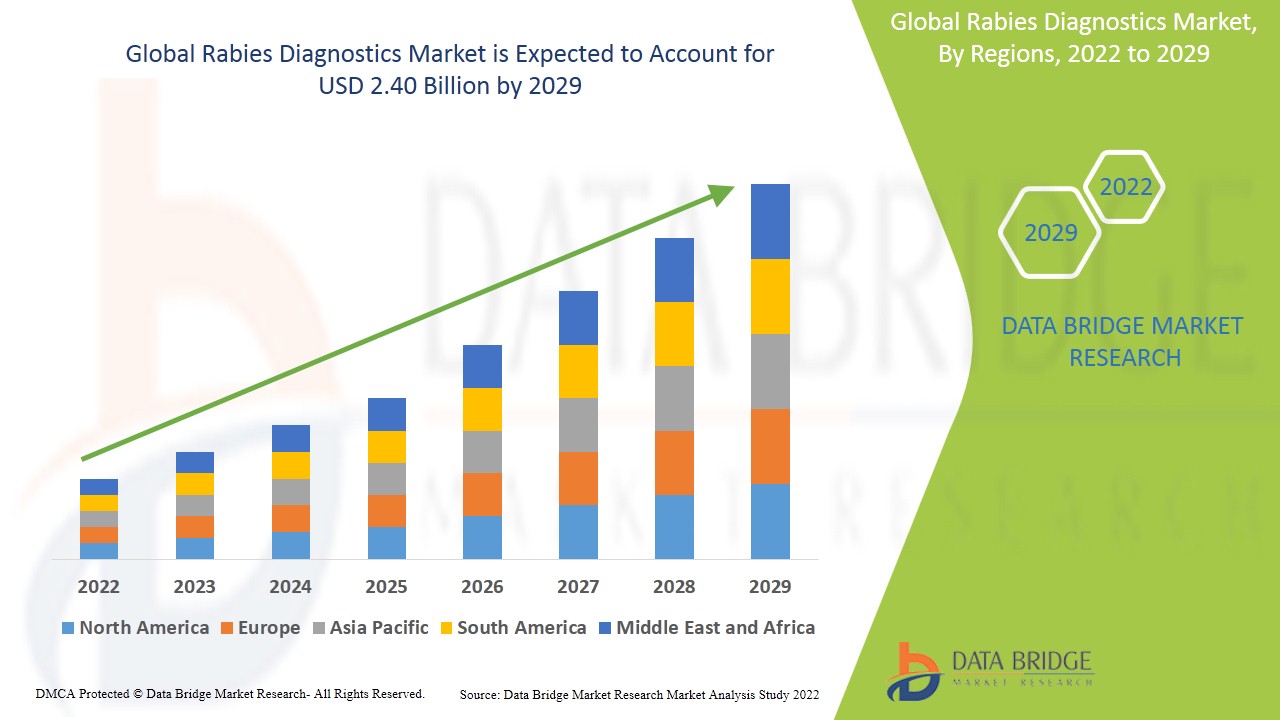

As of 2024, the global rabies diagnostics market was estimated to be worth approximately USD 1.2 billion. Driven by increased awareness, government health initiatives, and growing investment in veterinary healthcare, the market is projected to reach nearly USD 2.1 billion by 2033, growing at a compound annual growth rate (CAGR) of around 6.4% during the forecast period.

This market encompasses various diagnostic technologies and methods used in hospitals, research institutes, public health labs, and veterinary facilities to detect rabies infection in both humans and animals.

Key Market Drivers

1. Global Rabies Elimination Campaigns

The World Health Organization and partner organizations have set a target to eliminate dog-mediated human rabies deaths by 2030. As part of this vision, governments are increasing funding and surveillance programs to improve rabies detection and response. The expansion of such initiatives is propelling demand for diagnostic tests.

2. Increasing Incidence in Developing Regions

Rabies is endemic in over 150 countries, with the highest burden in low- and middle-income regions of Asia and Africa. High rates of animal bites, poor access to healthcare, and lack of awareness contribute to the disease burden. The growing need for surveillance in these regions is fueling the demand for affordable and accessible diagnostic tools.

3. Technological Advancements in Diagnostics

Recent advances in molecular biology, immunohistochemistry, and biosensing technologies have enabled more rapid, sensitive, and specific rabies testing. Innovations such as point-of-care devices and portable diagnostics are making early detection more feasible in remote and resource-limited areas.

4. Rising Veterinary Care and Pet Ownership

Increasing pet ownership and awareness about zoonotic diseases are driving the demand for rabies diagnostics in veterinary settings. Routine testing of domestic animals, especially dogs and cats, is becoming more common, contributing to market expansion.

Market Segmentation

By Diagnostic Technology

1. Fluorescent Antibody Test (FAT)

The FAT remains the gold standard for post-mortem rabies diagnosis in animals. It involves the use of fluorescent-labeled antibodies to detect viral antigens in brain tissue. Despite being accurate, it requires high-end laboratory facilities and trained personnel.

2. Polymerase Chain Reaction (PCR)

PCR-based assays are widely used for detecting viral RNA in saliva, cerebrospinal fluid, and skin biopsies. They offer high sensitivity and specificity and are increasingly adopted for both antemortem and postmortem testing.

3. Enzyme-Linked Immunosorbent Assay (ELISA)

ELISA kits are used to detect rabies virus antibodies in serum or cerebrospinal fluid. They are useful in vaccine efficacy studies, epidemiological surveys, and assessing post-exposure prophylaxis responses.

4. Immunohistochemistry (IHC)

IHC allows the detection of rabies antigens in formalin-fixed tissues using labeled antibodies. It is often used as a confirmatory test when FAT results are inconclusive.

5. Lateral Flow Assays (Rapid Tests)

These are portable, cost-effective, and easy-to-use devices, suitable for field diagnosis. Though less accurate than laboratory-based methods, they are crucial in low-resource settings for preliminary screening.

By Application

- Human Diagnostics: Used in hospitals and clinics to guide treatment following suspected exposure.

- Animal Diagnostics: Deployed in veterinary labs for testing domestic and wild animals.

- Research: Utilized in academic and public health laboratories for surveillance and vaccine development.

By End User

- Hospitals and Clinics

- Veterinary Clinics and Animal Hospitals

- Public Health Laboratories

- Research Institutes

- Diagnostic Laboratories

Regional Insights

North America

North America has a well-established healthcare infrastructure and effective rabies control programs. The United States and Canada have reported a significant decline in human rabies cases due to effective vaccination campaigns and surveillance. The market here is driven by innovation, high investment in research, and rising awareness.

Europe

European countries have largely controlled rabies in domestic animals. However, the risk persists due to wildlife reservoirs and pet travel. The region emphasizes routine surveillance and post-exposure diagnosis, particularly in Eastern Europe.

Asia-Pacific

Asia accounts for the majority of global rabies deaths, especially in countries like India, China, and the Philippines. Government campaigns to reduce rabies fatalities are increasing diagnostic capacity. International partnerships and funding are also enhancing access to diagnostics in rural areas.

Latin America

The region has made notable progress in reducing rabies cases, particularly in dogs. However, bat-transmitted rabies remains a concern in parts of Brazil and Peru. Ongoing vaccination and testing programs sustain the demand for diagnostics.

Middle East and Africa

These regions continue to face high rabies mortality due to low vaccination coverage and limited diagnostic infrastructure. Increasing international support and funding for rabies elimination are improving diagnostic access.

Emerging Trends

Portable Diagnostic Tools

The development of mobile and point-of-care diagnostic devices is transforming rabies testing in remote and underserved regions. These tools offer the advantages of speed, simplicity, and cost-effectiveness, allowing healthcare workers to make real-time decisions.

Integration with Digital Health

Rabies diagnostics are increasingly being linked with digital health platforms to enhance surveillance and reporting. Mobile apps and cloud-based databases help track cases and identify outbreaks more efficiently.

Multiplex Testing

New diagnostic platforms capable of detecting multiple pathogens from a single sample are gaining traction. This is particularly useful in differential diagnosis, where rabies may present with symptoms similar to other viral infections.

Partnerships for Global Access

Collaborations between public health agencies, nonprofits, and private companies are aiming to expand access to rabies diagnostics in endemic regions. These initiatives often include subsidized testing kits, training programs, and mobile lab setups.

Challenges

High Cost of Advanced Diagnostics

Sophisticated techniques like PCR and IHC require costly reagents, equipment, and trained personnel, limiting their availability in resource-poor settings. This financial barrier continues to hinder comprehensive rabies surveillance in developing countries.

Lack of Awareness and Infrastructure

In many rabies-endemic areas, the general population remains unaware of the disease’s severity and the importance of diagnosis. Additionally, inadequate laboratory infrastructure limits the reach of diagnostic services.

Regulatory Hurdles

Diagnostic products must undergo stringent regulatory approvals, which can delay market entry and innovation. Navigating complex regulatory landscapes, especially in multiple countries, poses challenges for manufacturers.

Competitive Landscape

The rabies diagnostics market is characterized by the presence of both global and regional players. Companies are focusing on:

- Product Development: Launching new assays and devices tailored for different healthcare settings.

- Strategic Collaborations: Partnering with health ministries, NGOs, and research institutions to improve access and build trust.

- Geographic Expansion: Entering emerging markets where the disease burden is high but access to diagnostics is limited.

Manufacturers are also investing in R&D to improve the accuracy, speed, and affordability of their diagnostic offerings, with special attention to mobile and field-deployable solutions.

Future Outlook (2025–2033)

The future of the rabies diagnostics market is poised for sustained growth, driven by a global commitment to eliminate rabies deaths and the need for robust surveillance systems. Key projections for the next decade include:

- Wider Adoption of Point-of-Care Testing: These solutions will become mainstream in field diagnostics and rural healthcare settings.

- Focus on One Health Approach: Recognizing the interconnectedness of human, animal, and environmental health, diagnostics will increasingly cater to integrated surveillance systems.

- Government Investments: More countries are likely to incorporate rabies testing into national health programs, boosting market demand.

- Vaccine-Diagnostics Integration: Companies will explore combined diagnostic and vaccination kits to streamline post-exposure management.

By 2033, technological advancements and expanded awareness will likely make rabies testing accessible, accurate, and affordable, enabling a significant reduction in rabies-related deaths.

Source: https://www.databridgemarketresearch.com/reports/global-rabies-diagnostics-market

Conclusion

The rabies diagnostics market is at a critical juncture as global health bodies ramp up efforts to eliminate this preventable yet deadly disease. The demand for reliable, accessible, and fast diagnostics is growing across human and veterinary domains. Innovations in testing technologies, strategic public-private collaborations, and increasing investments in healthcare infrastructure are propelling market growth.

While challenges such as affordability and awareness remain, the market’s long-term outlook is optimistic. Stakeholders who invest in accessible technologies and collaborate with public health agencies will play a vital role in achieving the goal of zero human rabies deaths by 2030.