QuickBooks Sales Tax Calculation Not Working – Causes, Fixes & Support Guide

Sales tax compliance is one of the most critical aspects of running a business. QuickBooks, whether Desktop or Online, provides...

Sales tax compliance is one of the most critical aspects of running a business. QuickBooks, whether Desktop or Online, provides built-in features to automatically calculate sales tax on invoices, sales receipts, and other transactions. However, many users report that QuickBooks’ sales tax calculation sometimes does not work correctly—leading to inaccurate tax amounts, missing calculations, or a complete failure to apply sales tax.

If your QuickBooks sales tax is not calculating properly, this article will guide you through the possible reasons, troubleshooting methods, and preventive measures to keep your accounting error-free.

Why Sales Tax Calculation Matters in QuickBooks

Sales tax is not just a regulatory requirement—it’s also an essential factor in maintaining accurate books. If QuickBooks fails to calculate it correctly, it can lead to:

- Wrong customer invoices.

- Compliance issues with state and federal tax authorities.

- Inaccurate financial reports.

- Potential penalties during audits.

That’s why resolving the QuickBooks sales tax not working issue should be a top priority for business owners and accountants.

Common Symptoms of Sales Tax Issues in QuickBooks

When the QuickBooks sales tax feature stops working, users often face:

- Sales tax is not appearing on invoices or receipts.

- Sales tax amount is showing as zero despite taxable items.

- Wrong tax percentage being applied.

- Error messages when enabling or editing sales tax settings.

- Tax codes are missing or not functioning properly.

Possible Causes of QuickBooks Sales Tax Calculation Errors

There are multiple reasons why QuickBooks may not calculate sales tax correctly. Some common causes include:

1. Incorrect Sales Tax Settings

If your sales tax preferences are not set up properly, QuickBooks may skip tax calculation.

2. Non-Taxable Item or Customer

If an item or customer is marked as non-taxable, sales tax will not be applied—even if your preferences are correct.

3. Outdated QuickBooks Version

QuickBooks regularly updates tax tables. If you’re using an outdated version, sales tax rules may not be up-to-date.

4. Company File Issues

Corruption or damage in your QuickBooks company file can disrupt sales tax functions.

5. Sales Tax Liability Mapping Errors

If sales tax is not mapped to the right account, QuickBooks might fail to calculate or display it properly.

6. Regional Tax Rules

Sales tax laws vary across states and cities. If you relocate or expand your sales without updating QuickBooks, your tax settings may not align with local regulations.

7. Improper QuickBooks Payroll/Sales Tax Updates

For QuickBooks Desktop, payroll and sales tax updates are often bundled. Skipping them can cause tax errors.

- How To Contact QuickBooks Enterprise Support?

- How do I Contact QuickBooks Enterprise Support by Phone?

- How do I Actually Talk to Someone in QuickBooks Enterprise?

- How do I Speak to a Human at QuickBooks Enterprise?

- How can I Talk to a Live Person in QuickBooks Enterprise?

- How do I Speak to a Representative at QuickBooks Enterprise?

- How To Contact QuickBooks Enterprise Support?

- How do I Communicate with QuickBooks Enterprise?

- Does QuickBooks Enterprise Have 24 Hour Support?

Step-by-Step Fixes for QuickBooks Sales Tax Not Working

Let’s go through effective troubleshooting steps to fix this issue.

1. Verify Sales Tax Settings

- In QuickBooks Online:

- Go to Taxes > Sales Tax > Edit settings.

- Ensure the correct agency, rate, and tax rules are active.

- In QuickBooks Desktop:

- Go to Edit > Preferences > Sales Tax.

- Check Yes, I charge sales tax.

- Ensure the correct tax items and groups are listed.

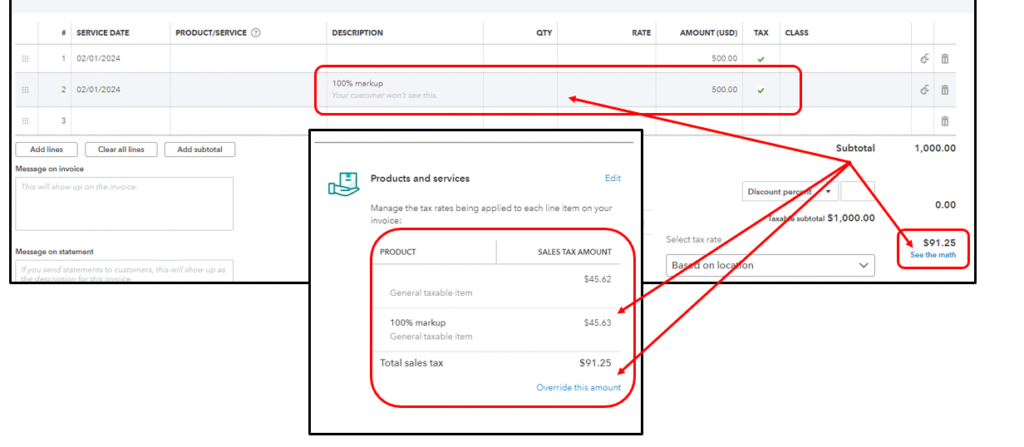

2. Check Item & Customer Taxability

- Edit the product/service item and ensure Taxable is selected.

- For customers, open their profile and check Tax Settings to ensure they are not marked as tax-exempt unless necessary.

3. Update QuickBooks & Tax Tables

- QuickBooks Online updates automatically, but you may need to log out and back in.

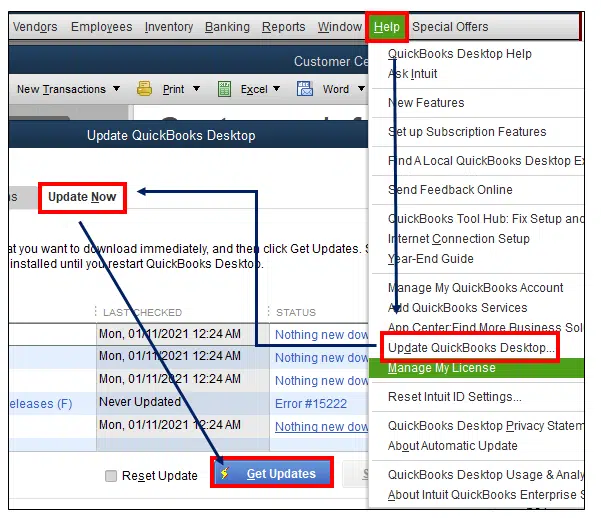

- QuickBooks Desktop users should:

- Go to Help > Update QuickBooks Desktop.

- Select Update Now > Get Updates.

- Also, update the Payroll Tax Table (even if not using payroll, as it includes tax updates).

4. Repair Damaged Company File

If settings are correct but sales tax still doesn’t calculate:

- Use the Verify & Rebuild Tool (QuickBooks Desktop).

- Run the Reconciliation Check to see if tax accounts are damaged.

- For QuickBooks Online, try exporting reports, clearing the cache, and reloading.

5. Reconfigure Sales Tax Codes

If sales tax codes are missing or corrupted:

- Delete and recreate sales tax items in Desktop.

- In Online, deactivate old tax codes and create new ones.

6. Apply Correct Regional Tax Rules

If you recently expanded to new states, set up nexus-based sales tax in QuickBooks Online. For Desktop, manually add new state tax items.

7. Check Browser/Cache Issues (QuickBooks Online)

Sometimes sales tax glitches in QuickBooks Online are browser-related:

- Clear browser cache and cookies.

- Try using Chrome in Incognito mode.

- Switch to another browser to test.

8. Contact QuickBooks Support

If none of the above fixes work, the issue may require technical intervention. You can contact the QuickBooks Support team at +1-888-209-3999 for specialized help.

Preventive Measures for Future Sales Tax Issues

- Always keep QuickBooks updated.

- Regularly review and reconcile sales tax liability accounts.

- Train staff to set up items and customers correctly.

- Enable automatic updates for QuickBooks Online.

- Back up company files regularly to avoid data corruption.

QuickBooks Desktop vs QuickBooks Online – Sales Tax Differences

| Feature | QuickBooks Desktop | QuickBooks Online |

| Sales Tax Updates | Manual via payroll updates | Automatic (cloud-based) |

| Multi-State Tax | Must set up manually | Nexus-based automatic |

| Error Chances | Higher (manual setup) | Lower (auto-calculation) |

| Fixing Issues | Requires Verify/Rebuild tools | Mostly browser or setting fixes |

When to Seek Professional Help

Sometimes fixing the QuickBooks sales tax calculation not working requires advanced troubleshooting, such as:

- Company file repair.

- Reinstallation of QuickBooks Desktop.

- Re-mapping the chart of accounts.

- Applying custom regional tax settings.

In such cases, it’s best to consult a QuickBooks ProAdvisor or Intuit-certified support team by calling +1-888-209-3999.

Final Thoughts

Sales tax errors in QuickBooks can be frustrating, but with the right steps, they are usually easy to resolve. By checking tax settings, updating QuickBooks, and ensuring proper item/customer taxability, most issues can be fixed in minutes. For persistent problems, contacting expert support is the fastest way to restore accurate calculations.

If your QuickBooks sales tax calculation is not working, don’t let it affect your financial records. Call QuickBooks Support at +1-888-209-3999 for immediate help.