Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Size and Share Analysis – Top Companies Analysis and GrowthTrends Insight Forecast Report 2025-2033

Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Size and Share Analysis: Growth Trends and Forecast Report 2025–2033...

Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market Size and Share Analysis: Growth Trends and Forecast Report 2025–2033

Market Overview

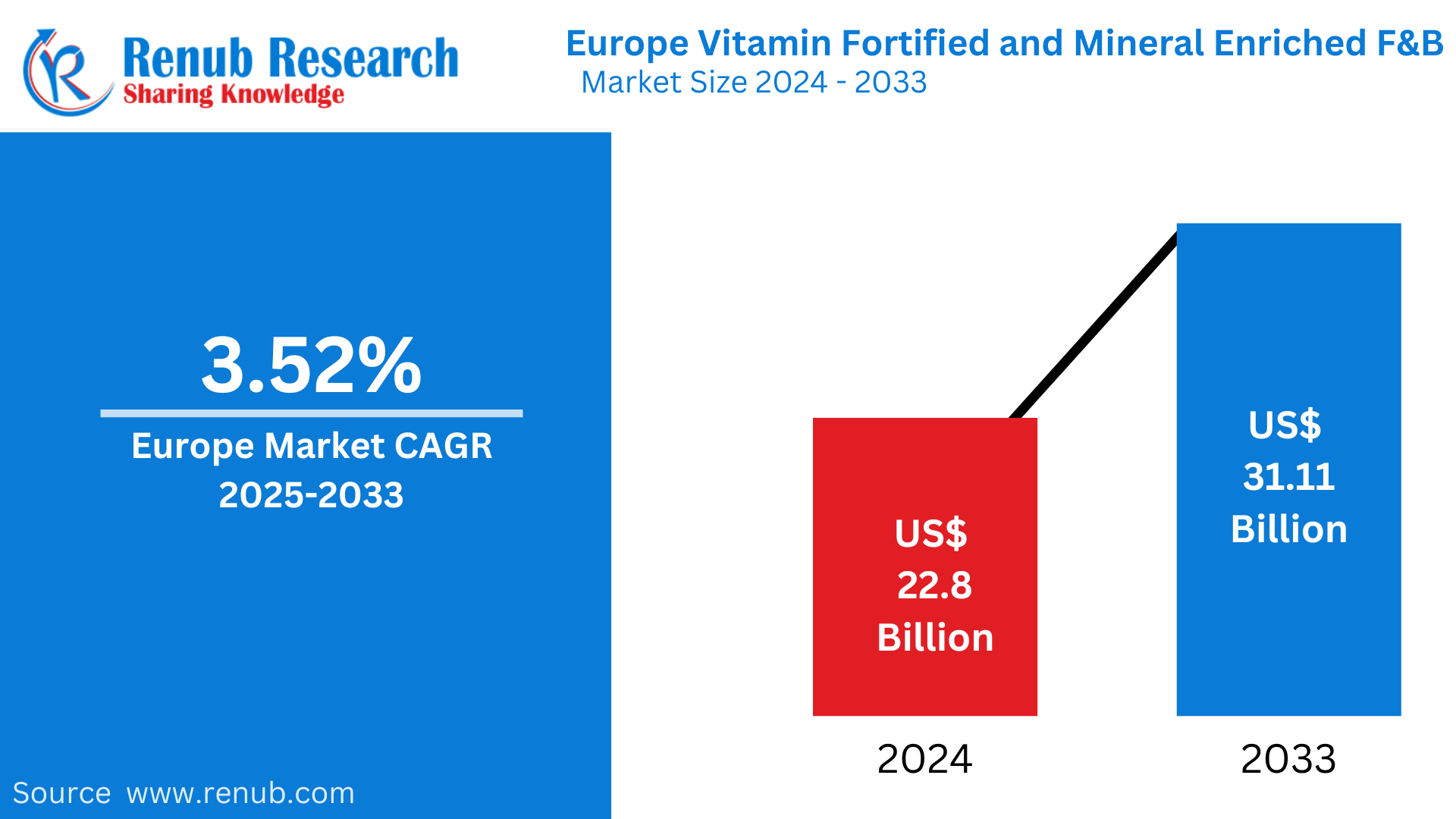

The Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market is expected to grow substantially, with an estimated value of USD 22.8 Billion in 2024, projected to reach USD 31.11 Billion by 2033, expanding at a CAGR of 3.52% from 2025 to 2030. The market’s growth is fueled by increasing health awareness, rising nutritional deficiencies, and growing demand for functional and convenient food options.

Market Definition and Significance

Vitamin-fortified and mineral-enriched foods and beverages are formulated to improve nutritional content by adding essential vitamins and minerals. While fortification involves adding nutrients not naturally present, enrichment replenishes nutrients lost during processing. These products support general health, reduce deficiency-related risks, and cater to dietary requirements of various population segments, including children, the elderly, and individuals with restricted diets.

Common fortified categories include:

- Cereals

- Dairy products

- Fruit juices

- Plant-based milk

Popular additions include:

- Vitamins: D, C, B-complex

- Minerals: Calcium, iron, zinc

Governments and health authorities across Europe advocate fortification to address public health issues, further supporting the market’s expansion.

Key Growth Drivers

1. Rising Health Consciousness and Preventive Nutrition Trends

European consumers are increasingly prioritizing health, driving demand for functional foods and drinks. This trend is largely influenced by:

- The surge in lifestyle diseases like obesity and diabetes

- Post-pandemic health awareness (60% of EMEA consumers became more health-conscious, with 42% attributing it to COVID-19)

- A shift towards immune-boosting products like Vitamin C, D, and probiotic-enriched options

Consumers are reducing meat, artificial additives, and preservatives, turning to fortified options for preventive care and wellness.

2. Government Regulations and Support

Government initiatives and regulatory frameworks, including those from European Food Safety Authority (EFSA), play a crucial role in:

- Encouraging food fortification to combat nutrient deficiencies

- Ensuring consumer safety through strict guidelines

- Promoting innovation in fortified products

The EU Green Deal and sustainability goals further push food manufacturers to adopt safe, compliant, and health-focused practices.

3. Growth of Fortified and Functional Beverages

Functional drinks such as fortified juices, plant-based milks, and energy drinks are witnessing increasing demand across Europe. Consumers prefer:

- Convenient nutrition for immunity, hydration, and energy

- Fortified beverages enriched with Vitamin C, Zinc, Calcium, and B12

- RTD (ready-to-drink) fortified products through retail and online channels

Related Report

- Europe Food Cans Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- United States Frozen Food Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- North America Baby Food Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

Key Market Challenges

1. High Production and Fortification Costs

Fortifying food and beverages requires:

- Advanced processing technologies

- Quality control systems

- Expensive sourcing of stable vitamins and minerals

These high costs affect pricing, limiting accessibility for smaller brands and price-sensitive consumers.

2. Consumer Skepticism and Misinformation

Despite rising health awareness, skepticism persists due to:

- Concerns over synthetic additives

- Misconceptions around nutrient overconsumption

- Lack of transparency in labeling and scientific validation

Addressing this skepticism demands educational marketing and clean-label packaging.

Segment Analysis

1. Cereal-Based Products

Highly popular across Europe, fortified cereals like breakfast cereals, granola bars, and breads are enriched with:

- Vitamin D, B-complex, Iron, and Calcium Health-conscious professionals and families prefer these for convenience and nutrition.

2. Fortified Beverages

Includes:

- Fruit juices with vitamins

- Electrolyte-rich waters

- Probiotic beverages

- Plant-based fortified milks (e.g., oat and almond)

Demand is driven by consumers seeking immunity, hydration, and energy benefits.

3. Fortified Food Products

Covers a wide range:

- Dairy, snacks, bakery items, and infant nutrition

- Examples include omega-3 enriched milk, fiber-rich bakery, and protein-fortified snacks

- Clean-label and plant-based innovations are in demand

4. Infant Formulas

A crucial category, fortified infant foods include:

- Iron, DHA, Calcium, Prebiotics Parents increasingly seek safe, organic, and plant-based formulas, guided by stringent EU safety regulations.

Distribution Channel Insights

Convenience Stores

Emerging as major distribution points for:

- Fortified snacks and beverages

- Single-serving packs for busy lifestyles

- Plant-based and allergen-free offerings

Online and Supermarket Channels

Retail chains and e-commerce platforms contribute significantly by offering variety, visibility, and ease of access.

Regional Market Highlights

Germany

One of Europe’s largest markets, driven by:

- Demand for clean-label, organic fortified products

- Growth in dairy alternatives and energy drinks

- Example: Operate Recovery sports drink launched in August 2022 with vitamins and minerals

France

Characterized by:

- Preference for premium, organic, and functional foods

- Demand for probiotics, omega-3, and fiber

- April 2023: Kellogg’s launched vitamin D-fortified Rice Krispies cereals

United Kingdom

Fast-growing market supported by:

- Government-led campaigns

- Vegan and winter immunity trends (e.g., Vitamin D-fortified cereals and milk)

- April 2023: Vitamin Well introduced a fortified drink with B12, folic acid, magnesium

Key Market Players

Leading companies actively innovating include:

- Kellogg’s

- Nestlé

- Danone

- Unilever

- Monster Beverages

- Operate Drinks

- Vitamin Well

These companies are focusing on:

- New product development

- Clean-label positioning

- Functional ingredient inclusion

Conclusion

The Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market is set for steady growth, propelled by consumer health trends, government regulations, and innovation in functional food technologies. While challenges like cost and consumer skepticism exist, the market’s robust foundation—especially in cereal-based foods, beverages, and infant nutrition—ensures long-term expansion.

🔍 Key Questions Answered in the Report

- What is the current size and forecasted value of the Europe Vitamin Fortified and Mineral Enriched Food & Beverage Market from 2024 to 2033?

- What are the main factors driving growth in the European fortified food and beverage market?

- How are government regulations and policies in Europe influencing the fortification trend?

- Which product segments—beverages, cereals, or infant formulas—are showing the highest demand and growth potential?

- What role is consumer health consciousness playing in shaping the demand for fortified food and drinks?

- What are the biggest challenges faced by manufacturers in producing fortified products?

- Which distribution channels are most preferred by European consumers for purchasing fortified food and beverages?

- Which countries in Europe—such as Germany, France, and the UK—are leading the market and why?

- What innovations and product launches by major players are shaping the competitive landscape?

- How are trends like plant-based diets, clean-label products, and immunity-boosting ingredients impacting the market?